Insurance stories

UK leads Europe in adoption of agentic AI for software gains

Last week

#

insurance

UK leads Europe with 47% of firms adopting agentic AI to boost software productivity, outpacing France and Germany amid global AI investment surge.

TEAMS Transport saves CAD $1 million with AI-powered fleet safety

Last week

#

insurance

TEAMS Transport cut high-risk driving by 48% and saved over $1 million on insurance using Samsara’s AI-powered fleet safety across its Canadian trucks.

Gresham names Hayley Zhu Sales Director to lead APAC growth

Last week

#

insurance

Gresham appoints Hayley Zhu as Sales Director to drive growth and lead strategy across Asia-Pacific’s evolving financial technology landscape.

AI shifts from adviser to architect in enterprise decision-making

Last week

#

insurance

A new study reveals AI is evolving from an adviser to a core architect in enterprise decision-making, enhancing transparency and accountability across sectors.

UK universities & insurers launch GBP £2 million AI risk project

Last week

#

insurance

UK universities and insurers have launched a GBP £2 million project to develop insurance products addressing risks from commercial artificial intelligence use.

Teradata VantageCloud delivers 427% ROI & cuts costs with AI

Last week

#

insurance

Organisations using Teradata VantageCloud achieved a 427% ROI and USD $7.9 million annual benefits, cutting costs and boosting AI model accuracy by up to 15%.

TCS Q1 revenue hits USD $7,421m, highlights AI & security wins

Last week

#

insurance

TCS reported USD $7,421m revenue in Q1 FY26, highlighting gains in AI and cybersecurity despite a slight year-on-year revenue decline.

Endava unveils new execs to drive AI & global engagement

This month

#

insurance

Endava appoints Alastair Lukies as Chief Engagement Officer and Rob Machin as Chief People and Locations Officer to boost AI-led growth and global engagement.

One Click Group adopts ConnectID for faster, safer ID checks

This month

#

insurance

One Click Group has integrated ConnectID to enable faster, safer identity checks, streamlining tax and financial services verification across Australia.

Adaptive partners with Tokio Marine for US parametric outage cover

Last month

#

insurance

Adaptive Insurance and Tokio Marine HCC launch GridProtect, a parametric insurance covering short-term power outages across 18 US states for SMEs.

Upcover unveils dedicated fintech insurance vertical in Australia

Last month

#

insurance

Upcover launches a dedicated fintech insurance vertical in Australia, offering tailored policies and faster digital solutions to support fintech firms' growth.

Poor data intake drives customer disengagement in Australia & NZ

Last month

#

insurance

Poor data intake and communication methods cause significant customer disengagement in Australia and New Zealand, says Smart Communications' 2025 research.

Low-mileage drivers save 10% less as usage-based insurance grows

Last month

#

insurance

UK drivers logging up to 6,000 miles annually pay nearly 10% less on insurance, as usage-based models and telematics gain traction amid rising living costs.

AI model boosts road safety & legal awareness for Australians

Last month

#

insurance

Right2Drive has launched an AI-driven tool to boost Australian drivers' awareness of road safety laws, accident claims, and legal rights for improved safety and understanding.

UK business leaders equate AI with utilities like water & energy

Last month

#

insurance

A survey finds 65% of UK business leaders rank AI as vital as water and energy, with 93% urging swift adoption alongside calls for thoughtful oversight.

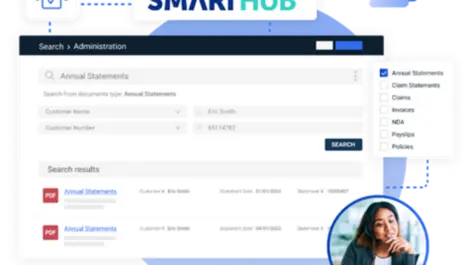

SmartHUB delivers cloud-native, secure archiving for compliance

Last month

#

insurance

Smart Communications launches SmartHUB, a cloud-native archiving solution enhancing data access, security, and compliance for sectors like finance and telecom.

AI to create new roles as Nimbl predicts job growth not loss

Last month

#

insurance

Nimbl predicts AI will create new job roles and growth, transforming the workforce with personalised services rather than causing redundancies.

Datadog launches enhanced log tools for cost & compliance needs

Last month

#

insurance

Datadog unveils enhanced log management tools helping firms cut costs and meet strict compliance, including long-term retention and local data storage options.

DAS launches climate dataset for rural property risk in Australia

Last month

#

insurance

DAS launches a new climate dataset to help insurers, banks and property firms manage long-term climate risks affecting rural Australia.

Denodo earns Snowflake financial services competency

Last month

#

insurance

Denodo has earned the Snowflake Financial Services Competency, recognising its expertise in secure data management for banking, capital markets, and insurance.